1. Street Sathi App (NASVI Membership Platform)

NASVI has launched the Street Sathi mobile application, exclusively for street vendors. Through this app, vendors can become registered NASVI members by paying a nominal annual membership fee of ₹50.

The app enables vendors to:

- Obtain NASVI membership

- Register their grievances

- Directly communicate issues to NASVI

- Access information on various welfare schemes

This digital platform strengthens vendor representation and ensures faster support.

2. Accident Insurance Scheme

NASVI provides an Accident Insurance Scheme for street vendors at an extremely affordable cost. By paying just ₹40 per year, a vendor is covered with ₹1 lakh accident insurance for one year.

In case of accidental death, the insured amount of ₹1 lakh is directly transferred to the nominee’s bank account, ensuring financial security for the vendor’s family.

3. LIC Jan Suraksha Insurance Scheme

In collaboration with Life Insurance Corporation of India (LIC), NASVI offers a long-term life insurance policy for street vendors.

Key features include:

- Insurance coverage of ₹2 lakh

- Premium payable for 15 years, while coverage continues for 20 years

- Benefits in case of accidental death or permanent disability

- In case of permanent disability, the insured receives ₹20,000 per year for 10 years

This scheme provides long-term financial protection and stability.

4. Health Plus Insurance Scheme

The Health Plus scheme provides medical coverage for vendors and their families.

Eligibility

- Adults: 18 to 65 years

- Children: 91 days to 21 years

Diseases Covered

Dengue, malaria, chikungunya, typhoid, Japanese encephalitis, lymphatic filariasis, cholera, hepatitis A & E, and gastroenteritis.

Premium Options

- Individual health insurance: ₹299 per year

- Family health insurance (husband, wife, and two children): ₹699 per year

Benefits

- Financial assistance up to ₹20,000, directly credited to the bank account

- No hospital admission required for claim settlement

This scheme ensures affordable healthcare access for street vendor families.

5. Hospital Cash Scheme

The Hospital Cash Scheme provides daily cash support during hospitalisation due to illness or accident.

Eligibility

- Adults: 18 to 65 years

- Children: 91 days to 21 years

Plan Options

- ₹123 annual premium:

- ₹500 per day (General Ward)

- ₹1,000 per day (ICU)

- ₹246 annual premium:

- ₹1,000 per day (General Ward)

- ₹2,000 per day (ICU)

Benefits are available for up to 30 days per year and are credited directly to the beneficiary’s bank account.

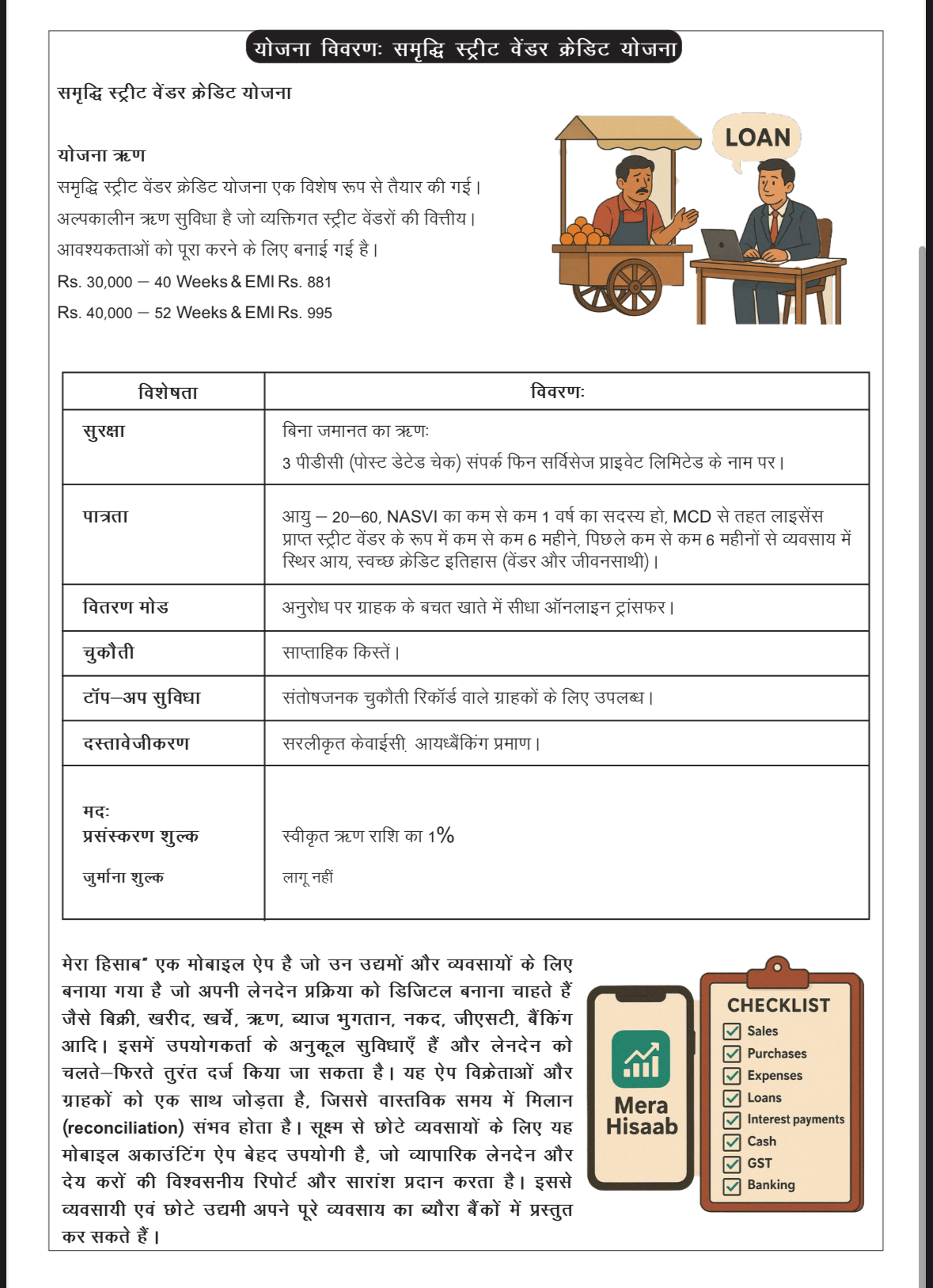

6. Samriddhi Street Vendor Credit Scheme

The Samriddhi Street Vendor Credit Scheme is a specially designed micro-credit programme for street vendors to meet their business and personal financial needs.

Loan Options

- ₹30,000 loan for 40 weeks (EMI ₹881)

- ₹40,000 loan for 52 weeks (EMI ₹995)

Key Features

- No collateral required

- Weekly repayment system

- Loan amount transferred directly to the vendor’s bank account

- Simple documentation and easy verification process

- Top-up facility available for vendors with good repayment records

This scheme promotes financial inclusion and business stability.

The MMMD approach ensures that interventions remain both market-oriented and mission-driven, focusing on sustainable income opportunities while safeguarding the rights, dignity, and well-being of street vendors.